Valuation risks of relying on Inferred Resources

Successful exploration programs reach a stage where there are substantial Inferred Mineral Resources. If the mineralisation is still open laterally and/or at depth, there is a natural desire to continue exploration to increase the resource base. A Scoping Study is often completed to assess the potential technical and economic viability of the deposit.

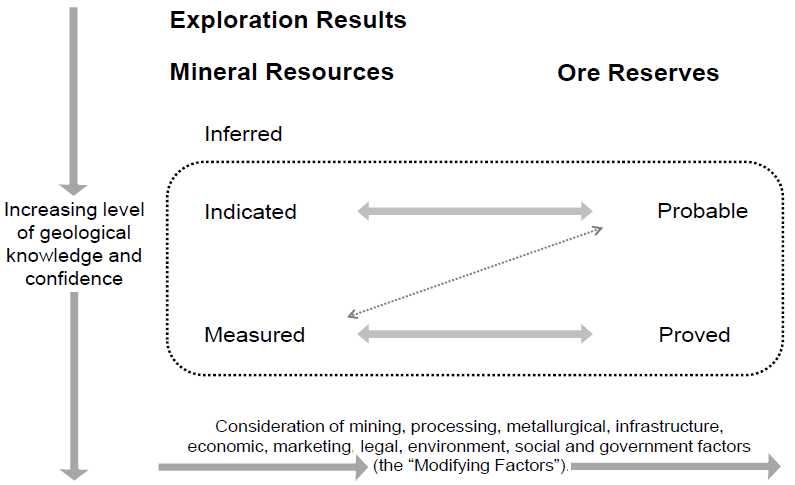

The JORC Code[1] defines an Inferred Mineral Resource as “that part of a Mineral Resource for which quantity and grade (or quality) are estimated on the basis of limited geological evidence and sampling” and further states that “an Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to an Ore Reserve” and “caution should be exercised if Inferred Mineral Resources are used to support technical and economic studies such as Scoping Studies”.

Despite these cautionary words, the excitement of discovery success can lead to companies placing too much emphasis on these “lower-confidence” resources. This is why the JORC Code specifies that “a Scoping Study must not be used as the basis for estimation of Ore Reserves” and “for all Scoping Studies, the entity must include a cautionary statement in the same paragraph as, or immediately following, the disclosure of the Scoping Study”.

Although there is a reasonable expectation that Inferred Mineral Resources will be converted to Indicated Mineral Resources with further exploration, this is by no means guaranteed. The geological continuity implied by the initial sampling may not be confirmed by more closely-spaced sampling, and the grade or quality estimates may change significantly (better or worse). Greater variability in the quantity and quality parameters of the mineralisation is also likely as detailed exploration progresses.

The VALMIN Code[1] contains requirements in respect of valuation approaches and explicitly prohibits the use of in situ values. Inferred Mineral Resources cannot be converted to Ore Reserves and cannot be the basis for a valuation using an income-based approach. The VALMIN Code further states that “it is generally acceptable to use all Proved and Probable Ore Reserves in the Income Approach. It may sometimes be appropriate to include other classifications, but these must, subject to the Reasonableness Test:

- meet the minimum reporting requirements of the ASX Listing Rules and guidance, the ASIC Regulatory Guidelines and guidance, and the JORC Code;

- not include Exploration Targets that have not been converted to Production Targets;

- be scheduled for extraction behind Proved and Probable Ore Reserves, where it is practical to do so;

- include a statement by the Specialist that confirms the appropriateness of the Modifying Factors along with a description of their level of certainty relative to those of a Feasibility Study or Pre-feasibility Study;

- be discounted in a manner that is commensurate with the increased uncertainty.”

This means that if Inferred Mineral Resources are included in a life-of-mine plan to be used in an income-based valuation, this typically results in significant discounts being applied to the assigned values for quantity and quality of Inferred Mineral Resources, and up to a 50% reduction in the resulting amount of contained metal or other valuable product is not uncommon. Such a reduction in the value ascribed to the potential income derived from the extraction of Inferred Mineral Resources often comes as an unpleasant surprise to clients, especially if their project has little or no higher-confidence Mineral Resources or Ore Reserves.

Similarly, when using a market-based approach for valuation such as Comparable Transactions, the unit value typically applied to Inferred Mineral Resources is almost always significantly lower than for higher confidence Mineral Resources and Ore Reserves.

For those projects with significant Inferred Mineral Resources but little else, consideration should be given to committing some or even all of the next stage of exploration drilling to upgrade Mineral Resources rather than expanding the Inferred Mineral Resource. There is no definitive answer to just when the focus should switch from adding resources to upgrading resources, but once a Scoping Study has been completed with encouraging results, the next stage should include a significant budget to upgrade the resource base to underpin a Pre-feasibility Study and the estimation of Ore Reserves. Often, this can be done concurrently with expanding the resource base.

In Derisk’s experience with valuation of pre-development and development projects, too many companies focus on increasing the Inferred Mineral Resource base to add value, rather than increasing the confidence in the resource base and generating Ore Reserves, which would have likely resulted in a higher valuation.

[1] Australasian Code for Public Reporting of Technical Assessments and Valuations of Mineral Assets (The VALMIN Code), 2015

For more information

Mark Berry (Director and Principal Geologist)

+61 4 0802 9549

mark@deriskgeomining.com