Valuing operations with minimal Ore Reserves

Many mining projects, particularly narrow vein underground precious metals projects, have limited Ore Reserves defined at any time. But many of these projects have a long operating life, continually replenishing depleted Ore Reserves to maintain a rolling production forecast of a few years. Most of these projects have sufficient additional Mineral Resources (often mostly in the Inferred category) or Production Targets to support a few more years of production. In some parts of the world, it is normal to start and operate projects with little or no Ore Reserves and often without the benefit of a formal feasibility study. Whilst these situations may not be a problem for the operating companies, they can be a major headache for consultants engaged to provide an independent valuation.

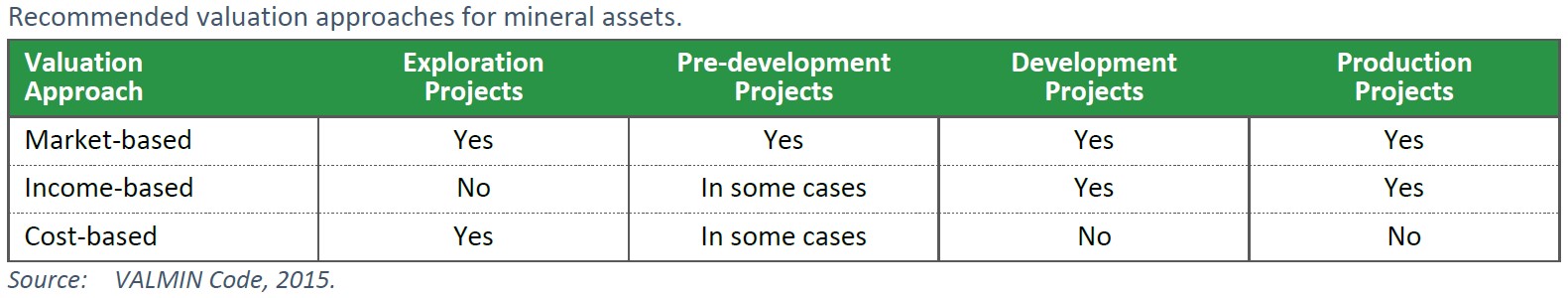

The VALMIN Code[1] states that at least two valuation approaches should be used to value mineral assets and provides guidance on appropriate valuation approaches for each category of asset, as shown below.

This means that a market-based approach and an income-based approach should normally be used for any production project. A market-based approach can be applied to all mineral assets and is appropriate whether or not the project has reported any Ore Reserves, so this is not a problem for valuation purposes.

An income-based approach (which is a technical valuation) is based on the notion of expected future cashflow generation and is usually derived from the project’s life-of-mine plan. The VALMIN Code requires that subject to a reasonableness test and provided they meet the minimum reporting requirement of the JORC Code[1] that:

- All Ore Reserves and Mineral Resources must be considered (but not necessarily included).

- Exploration Targets can only be included if they have been converted to Production Targets.

- Mineral Resources and Production Targets should be scheduled for extraction after Ore Reserves where it is practical to do so and must be discounted to reflect their increased uncertainty.

- The valuing Specialist must include a statement that confirms the appropriateness of the modifying factors applied.

It is not unusual to find operations whose life-of-mine plans or production forecasts are not consistent with the above requirements. At times, not all categories of Mineral Resources or Production Targets are included, and in other cases they are included but without any modifying factors or discount factors applied. Also, Mineral Resources and Production Targets may be scheduled for extraction ahead of Ore Reserves without adequate justification. The forecast may even extend beyond the depletion of all identified mineral assets, based on expected future discoveries (often with some historical justification).

In such cases, the valuing Specialist may need to develop a new production forecast from which an income-based valuation can be derived. This new forecast must comply with the VALMIN Code and reflect the practical and operational realities of the project. Whilst it may not align with the existing forecast, it must be achievable within the current operational and financial constraints of the operation. It may need to include additional capital expenditure (e.g. to upgrade Mineral Resources or Production Targets to Ore Reserves) and other adjustments based on the judgement of the valuing Specialist. Some Mineral Resources or Production Targets may need to be excluded from the new forecast for a variety of reasons. It is important that the basis of the new forecast and the reasons for any significant differences to the existing forecast be explained to the appropriate client personnel, even though they may not fully agree.

The most likely contentious issue will be the adjustments to the tonnages and grades of Mineral Resources and Production Targets to achieve realistic tonnages and grades for inclusion in the production forecast developed by the valuing Specialist. This will involve the application of modifying and/or risk factors as outlined above and may result in significantly lower values for either or both parameters. The project records may provide guidance from historical conversion factors for the various classes of Mineral Resources to Ore Reserves, or from historical reconciliation factors that will help in selecting appropriate modifying factors.

If the production forecast used for the valuation comprises a high proportion of tonnage based on Inferred Mineral Resources and/or Production Targets, and especially if this material is scheduled in the early years of the forecast, the valuing Specialist may apply a risk discount to the undiscounted cashflow to reflect the lower level of confidence of its tonnage and grade. In the end, the valuing Specialist must be satisfied that the resulting valuation (usually a range based on discounted cashflows) realistically reflects the project’s income generating potential and related risks in accordance with the relevant codes. Further adjustments may be applied if this Technical Valuation is converted to a Market Valuation.

At the completion of the valuation, it is likely that projects with minimal Ore Reserves will be valued less than similar projects with larger Ore Reserves, even where the total Mineral Resource inventory may be similar. This suggests that sometimes more value can be added to a project by upgrading resources to reserves than by increasing the resources.

[1] Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (The JORC Code), 2012

For more information

Mark Berry (Director and Principal Geologist)

+61 4 0802 9549

[email protected]