How important is a pre-feasibility study?

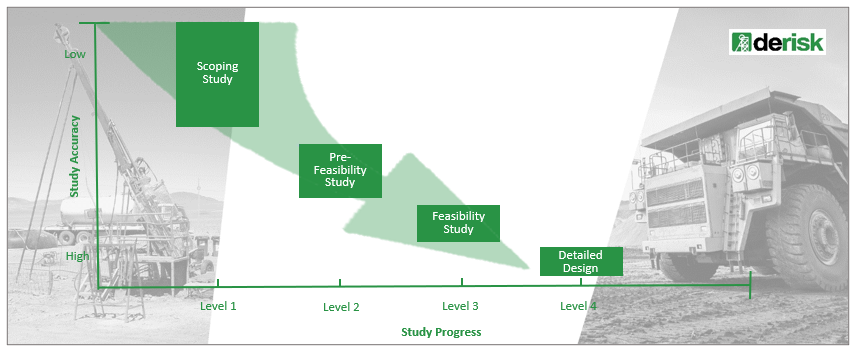

The typical study sequence for mineral projects envisages three or four significant study levels as a project progresses from exploration to production:

- Level 1: Scoping Study, also called a Conceptual Study.

- Level 2: Preliminary Feasibility Study or Pre-feasibility Study (PFS).

- Level 3: Feasibility Study, also called a Definitive or Bankable Feasibility Study.

- Level 4: Detailed Design Study.

Each of these studies occurs at a different point in the life of a project and each serves a different purpose, although all are intended to underpin a commercial decision regarding the future of the project. In some cases, companies try to fast track their projects and/or save costs by skipping the PFS stage, often in the mistaken belief that a PFS is a Feasibility Study done at a lower level of detail and accuracy. They reason that if the Scoping Study is very encouraging, then why waste time and money on a PFS. However, this demonstrates a lack of understanding of the purposes and limitations of the various study levels.

A Level 1 Scoping Study is usually undertaken once exploration has generated sufficient results to suggest that an economic operation may be possible. It is intended to justify further exploration expenditure and may be used to rank projects competing for scarce funds. Because of the low confidence level in the Exploration Results or the Mineral Resource at this stage, and the desire to minimise time and costs, high-level inputs are used, and the accuracy of outputs is limited, typically in the order of ±35-45%. Because of this limited accuracy, it is important to take an optimistic view so that a potentially profitable opportunity is not lost.

If the project then progresses and enjoys further exploration success, a more detailed and accurate assessment of the project’s potential viability will be required to justify ongoing expenditure. By now there is likely to be significant Mineral Resources, some at an Indicated Resource category and possibly even some Measured Resources to support a Level 2 PFS. In line with JORC Code guidelines, this may result in the estimation of Ore Reserves if the economics are favourable.

The main purpose of a PFS is to evaluate possible options for developing the project and test the economic viability of the most favourable options at a higher level of detail and accuracy than a Scoping Study, typically in the order of ±20-25%. There are usually many options and strategies evaluated, including timing, production rates, mining methods, processing routes and financing options. Usually one or two scenarios that offer the most attractive opportunities will be found and hopefully these appear sufficiently profitable to justify further expenditure and a more detailed assessment after more work is completed.

In due course, exploration should have an increasing focus on upgrading resources to the Indicated and Measured category to support a Level 3 Feasibility Study. This study is usually the basis for a corporate decision to proceed with the development of the project, with the commensurate financial commitment. It will take the preferred scenario(s) from the PFS and evaluate them at a higher level of detail and accuracy, typically in the order of ±10-15%. This higher level of detail and accuracy will require considerably more time and money than previous studies. Sometimes the outputs from a Feasibility Study are sufficient to proceed directly to development and construction, or they may be further refined and optimised in a Level 4 Detailed Design stage, especially if there has been a significant time delay between the Feasibility Study and the start of development.

If a PFS is omitted, the evaluation of multiple options is missing and the Feasibility Study has no preferred scenario(s) on which to be based. There may be reluctance to allocate sufficient time and money to this critical aspect at this much more expensive stage of the project and this may mean that fewer options are properly considered, often resulting in a sub-optimal outcome. Even worse, if the Feasibility Study outcome does not meet the corporate hurdle for further investment, much more time and money will have been committed to the project than if this had been discovered at the PFS stage.

It is also possible, especially for smaller projects, that the outputs from a PFS are viewed as sufficient to support a decision to proceed directly to development without a Feasibility Study. This is a very risky strategy as the level of detail and accuracy of a PFS is unlikely to produce a fully optimised project, and the cost of optimising a project during development or production is likely to be an order of magnitude higher than the cost of a Feasibility Study. Alternatively, the project may never be fully optimised and may never deliver to its full potential.

Derisk considers that a PFS is a vital and cost-effective component of the progression of a project from exploration to production. Its purpose and limitations should be clearly understood so that it is not omitted and not relied upon for outputs for which it is not intended. It should ensure that a wide range of possible options and strategies are properly considered, resulting in a project that is more likely to be optimised. But it is not a low-budget substitute for a Feasibility Study.

For more information

Mark Berry (Director and Principal Geologist)

+61 4 0802 9549

[email protected]