Due diligence: How long is a piece of string?

Companies considering an option to purchase a mineral asset generally embark on some form of technical due diligence, review or audit to assess the asset and inform management of the key technical and financial risks and opportunities associated with the asset.

Those companies with a management team with a strong exploration and mining expertise generally have a good understanding of what level of technical due diligence is required to support a potential acquisition, and may also have the staff to complete the due diligence internally. Those companies without in-house technical expertise are generally reliant on external services to assist them in their technical due diligence. Also, non-technical management teams may be uncertain about the level of technical due diligence that is required to support an acquisition decision.

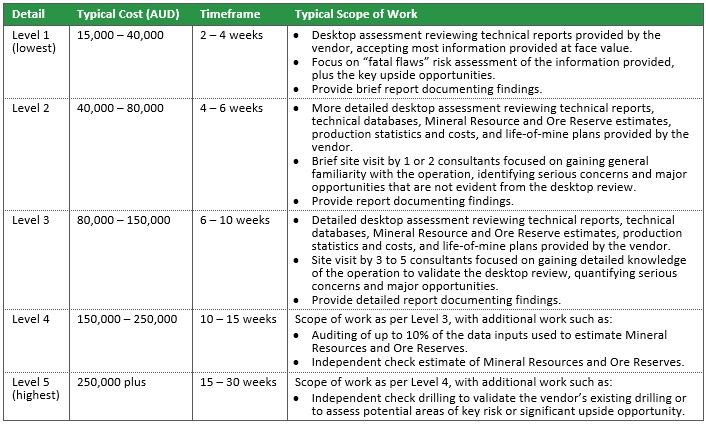

During initial discussions with potential clients, Derisk is regularly asked to provide an indicative cost and timeline for undertaking technical due diligence. Often, our first response to this query is that “It depends” and/or “How long is a piece of string?” This initial non-committal response arises because it is impossible to estimate the cost and time of a due diligence without knowing the client’s needs in detail. We have defined five levels of due diligence, summarised below, that vary greatly in both cost and time. Consequently, we have to carefully understand exactly what a client wants from their due diligence before assembling an appropriate scope of work that can then be used to estimate the cost and timeline.

Some of the factors that can influence how detailed a due diligence might be for a mineral asset include:

- The price of the asset. Mineral assets vary widely in price, from less than USD 1 million to more than USD 2 billion. Typically, companies spend more on due diligence as the acquisition cost increases.

- The complexity of the asset. Some mineral assets are relatively simple and have well defined controls on mineralisation, simple mining options and well-established processing methods. However, some assets can be complex, from a geological, mining, processing or environmental management perspective. Due diligence for complex assets tends to be greater than due diligence for simple assets.

- The nature of the investment. Due diligence may vary for a company seeking a passive investment in an asset, compared with that required when a company will be taking over the management and operation of an asset.

- The risk profile of the client. Clients with a high-risk appetite sometimes undertake less due diligence than clients with a low-risk appetite. Typically, clients have a higher-risk appetite when assessing assets that the management team has a strong familiarity with.

Consequently, our approach with all our potential clients is to spend whatever time is required to understand exactly what is needed from a technical due diligence. Once this is done, we can suggest a scope of work, cost and timeline knowing that this perfectly meshes with our client’s objectives.

Please contact Mark to discuss how Derisk can assist with your company’s due diligence requirements.

For more information

Mark Berry (Director and Principal Geologist)

+61 4 0802 9549

mark@deriskgeomining.com